Financial independence and security are foundational parts of a stable life. Alongside its associated economic benefits, financial independence is often also a pathway towards further education, confidence and even empowerment. However, for many rural Indians, factors such as un- and under-employment and large financial debts keep financial independence far out of reach. Unemployment rates across India remain at a 45-year high. For youth in rural areas, jobless rates for men and women stand at 17.7 and 13.6 percent, respectively. Furthermore, a nationwide government survey conducted by the National Sample Survey Office (NSSO) in 2013 reported that 31.4% of rural Indian households held some level of debt, with the average outstanding cash due standing at Rs 32,522. To address these needs, government and social sector organizations must work to create stable, well-paying jobs that keep families out of debt and allow them to build a stable future.

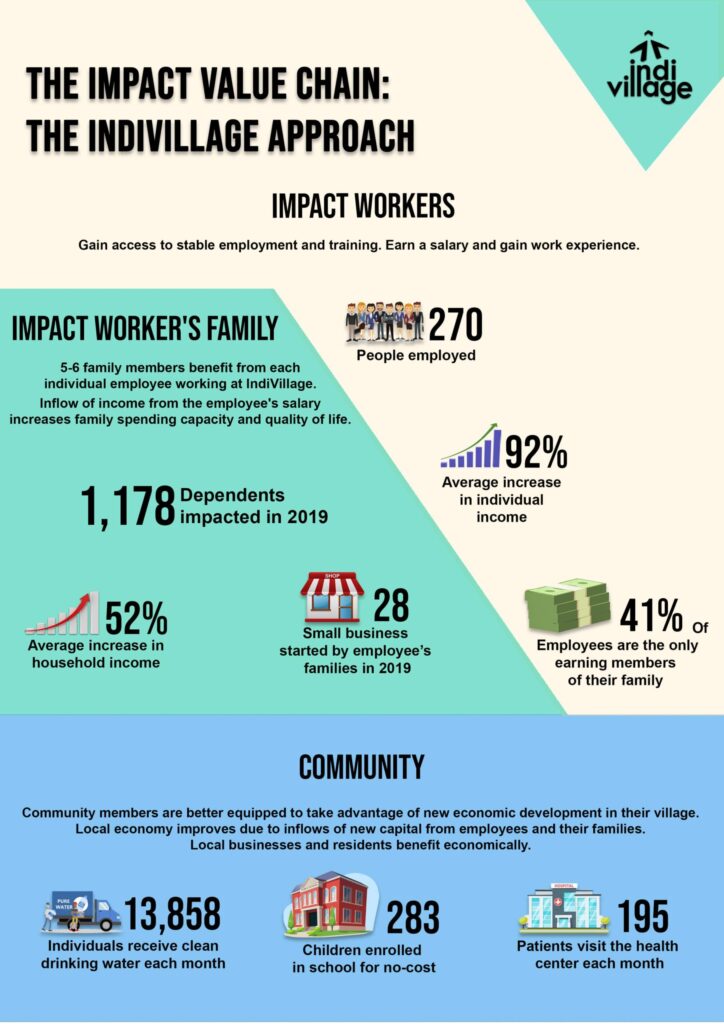

At IndiVillage, we work to provide employment in rural India and ensure that our employees are empowered with the financial means and knowledge to take control of their circumstances. To mark the beginning of the new financial year for many of us, we asked some of the female employees in our Yemmiganur and Raichur centers about the role that financial independence plays in their own lives. From allowing them to pay for their and their family members’ educations, to enabling them to feel self-sufficient, their responses indicated that financial independence means much more than simply making a living. Through our impact sourcing centers and profit-for-all community model we will continue to work to guarantee that an increasing number of residents of rural villages across India achieve financial security, whatever their definition.

Written By: Maura Heinbokel